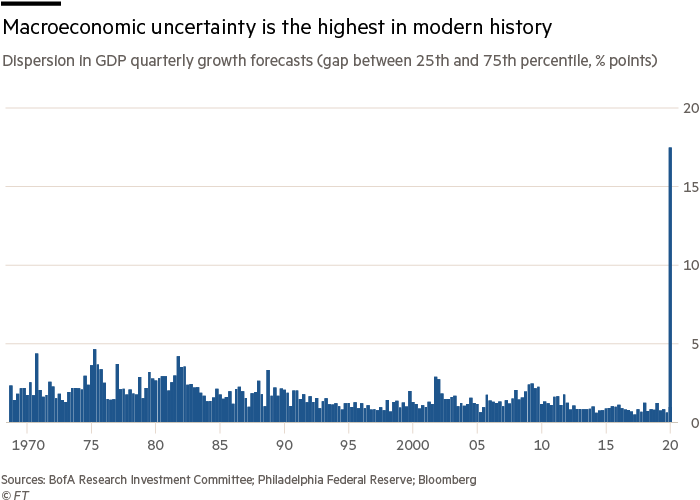

The global economic outlook is the murkiest in modern history, with uncertainty over the coronavirus outbreak’s ultimate impact causing wild divergences between analysts’ forecasts.

The dispersion in macroeconomic estimates is the greatest since at least the 1960s, according to Bank of America. Quoting Russian revolutionary leader Vladimir Lenin, BofA’s analysts said: “There are decades where nothing happens, and there are weeks where decades happen.”

The IMF last week forecast that the global economy would swing from a 2.9 per cent growth rate in 2019 to a contraction of 3 per cent this year. That is down from a forecast in late January for a 3.3 per cent expansion, and would constitute the most severe recession since the Great Depression of the 1930s.

The IMF warned that this year’s crisis, which it dubbed the “Great Lockdown”, would also leave more lingering economic scars than many analysts expect. “There remains considerable uncertainty around the forecast, the pandemic itself, its macroeconomic fallout and the associated stresses in financial and commodity markets,” the fund said.

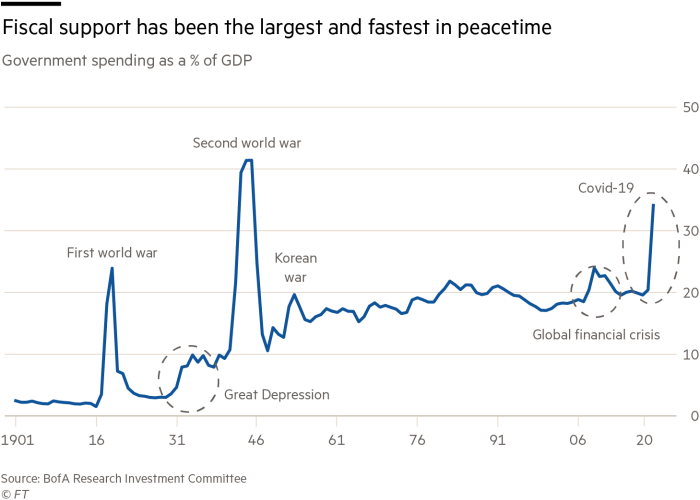

However, governments and central banks have gone to extraordinary lengths to reduce the economic damage. US lawmakers have passed a $2tn stimulus package, which has led to the fastest and biggest increase in US public spending relative to gross domestic product in peacetime, according to BofA.

“The key lesson from 1929 and 2008 is that big, fast policy action is essential to avoid [a] depression,” the bank said in a report. “‘Targeted’ measures stink of miserly austerity; only indiscriminate, abundant largesse can ‘flatten the curve’ of personal and corporate bankruptcies.”

The US, the analysts said, had “learned that lesson”.