The European Central Bank has added an extra €600bn to the bond-buying programme that it launched to support the eurozone’s pandemic-stricken economy as it steps up its efforts to stop the region sliding into a deflationary spiral.

The move to increase the ECB’s pandemic emergency purchase programme (PEPP) to a new total of €1.35tn was slightly larger than most economists’ expectations and means the central bank is on track to buy a record total of more than €1.7tn of assets this year.

The ECB also extended the timeframe of its emergency bond-buying scheme until June 2021 and said it would “continue net asset purchases under the PEPP until it judges that the coronavirus crisis phase is over”.

The PEPP had been on track to run out of firepower by October, having already spent more than €234bn of its original €750bn total by late May.

Some investors had worried that the bond-buying plan would not be sufficient to soak up the extra debt of between €1tn and €1.5tn that eurozone governments are expected to issue this year, leaving some of the worst-hit countries, such as Italy, facing a surge in their borrowing costs.

Yields on Italian and Greek government debt dropped sharply after the announcement; yields fall when prices rise. The yield on 10-year Italian debt dropped 16 basis points to 1.41 per cent and on equivalent-maturity Greek debt fell 13bp to 1.40 per cent, the lowest level since early March. The difference between yields on 10-year German and Italian bonds — a widely watched indicator of eurozone political risk — declined to 1.76 percentage points, its narrowest since late March.

Announcing the decision on Thursday, the central bank said: “In response to the pandemic-related downward revision to inflation over the projection horizon, the PEPP expansion will further ease the general monetary policy stance, supporting funding conditions in the real economy, especially for businesses and households.”

Coming only weeks after Germany’s high court ruled that the ECB’s older sovereign bond-buying scheme had breached the country’s constitution, the central bank’s latest move shows it is determined not to let the ruling hamper its freedom to act.

Keeping its main deposit rate unchanged at minus 0.5 per cent, the ECB said: “The maturing principal payments from securities purchased under the PEPP will be reinvested until at least the end of 2022.”

It added: “In any case, the future roll-off of the PEPP portfolio will be managed to avoid interference with the appropriate monetary stance.”

Some of the pressure on the ECB has been lifted since the EU set out a proposal to create a €750bn recovery fund, a move that eased strains in government debt markets. But the EU recovery fund is still being debated and unlikely to make much impact until next year. Meanwhile, the eurozone economy is heading for a record postwar recession while teetering on the brink of deflation.

The ECB’s latest move shows Christine Lagarde, the central bank’s president, wants to stay ahead of the curve, having been forced to apologise to colleagues in March for giving the impression that she was reluctant to act to combat a sell-off in the bonds of southern European countries, some analysts said.

“To judge by the size of today’s uplift, it appears that [Ms] Lagarde has well and truly learned her lesson from early March’s mis-step,” said Kenneth Wattret, chief European economist at IHS Markit. “The ECB has bought itself some time but the pressure will inevitably build to do more.”

Strategists at ABN Amro argued that “a further increase in the PEPP envelope will likely follow later this year”.

“This reflects the deep recession in the economy and the significant disinflation it will trigger over the coming years,” they said.

Ms Lagarde said the eurozone economy was “experiencing an unprecedented contraction”, adding that “severe job and income losses and exceptional uncertainty” had led to a “severe fall” in both consumer spending and investment.

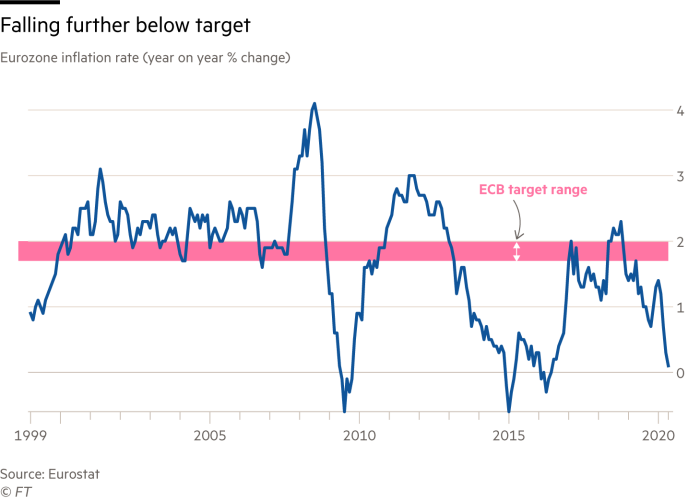

Inflation in the eurozone slid to 0.1 per cent year on year in May because of a sharp drop in energy prices, moving further away from the ECB’s inflation target of below but close to 2 per cent.

Economists worry that a prolonged period of deflation would be painful for the eurozone because it would make the bloc’s high levels of corporate and government debt even harder to manage as interest payments stay fixed but wages, prices and tax payments would all fall in cash terms.

The downward pressure on prices has been intensified by a sharp fall in consumer spending during the coronavirus lockdowns. Eurozone retail sales tumbled 11.7 per cent in April, the fastest pace on record, data published on Thursday showed.

This year’s aggressive bond-buying by the ECB follows similarly vast asset purchases by the US Federal Reserve, the People’s Bank of China, the Bank of Japan and the Bank of England. Together, the five central banks’ combined balance sheets already exceed $23tn, according to research firm Haver Analytics.

Additional reporting by Philip Stafford in London