Six years of negative interest rates have done as much to boost profitability at eurozone banks as they have to weigh it down, the European Central Bank said in a research paper that is likely to raise eyebrows among financiers.

Rebuffing the claims often made by lenders that the central bank’s sub-zero deposit rate is a big reason for their weak returns, ECB economists calculated that the controversial policy was a “broadly neutral” factor for bank profitability.

The findings may be contested by some bank executives, who complain that their sector has paid €25bn in negative rates to the central bank since its deposit rate went below zero in June 2014, eating into their already weak profits.

Negative interest rates turn the principles of finance on their head by making commercial lenders pay to keep money at the central bank instead of earning interest on it. The idea is to encourage banks to lend more, while cutting financing costs for companies and consumers.

But since the policy was introduced in the eurozone, Japan, Switzerland and Denmark, debate has raged in central banking circles on whether it works or if it is undone by damaging side-effects for the financial system.

The ECB cut its deposit rate to a record low of minus 0.5 per cent in September. That prompted some lenders to warn they would start passing on more of the costs by charging their larger depositors, even though the central bank gave the sector an exemption from negative rates for a chunk of its excess deposits.

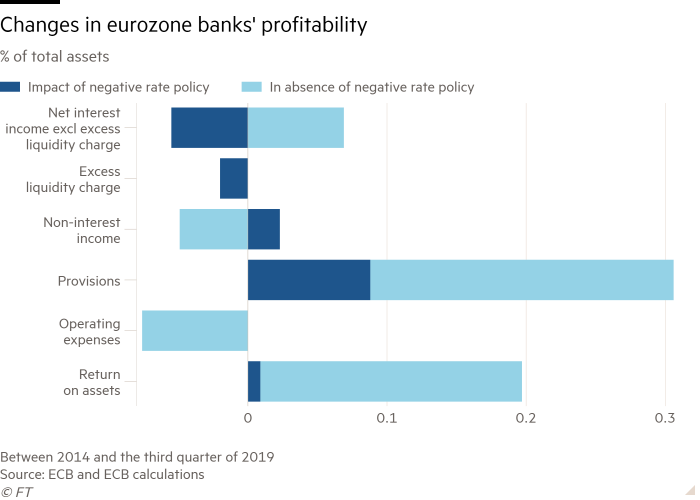

While the ECB economists acknowledged that negative rates have squeezed the traditional lending margins that banks generate by earning more on loans than they pay to depositors and bondholders, they said there were just as many positive effects to offset this.

Among the benefits they said banks had received from sub-zero rates, they listed a lower level of provisions for bad loans because of cheaper financing costs and higher economic growth, as well as increased demand for loans and a rise in the value of debt securities they owned.

“Negative interest rates have had a broadly neutral impact on bank profitability so far, as their negative effect on net interest income has been offset by a positive effect on borrower creditworthiness,” said Miguel Boucinha and Lorenzo Burlon, the authors of the paper.

Other economists, such as Markus Brunnermeier and Yann Koby at Princeton University, have found that many of the benefits of negative rates are front-loaded, such as gains in asset prices on banks’ balance sheets, while the corrosive side-effects last longer.

The ECB acknowledged that the longer negative rates lasted, the more they risked becoming counterproductive. “In the current euro area monetary policy environment, the effects of a long period of negative rates require continuous and careful monitoring as we venture further into uncharted territory,” it said.

The report said there was “no evidence of large-scale shifts into cash among depositors such as households, corporates or non-bank financial institutions” in response to sub-zero rates.

Banks have in the past six years almost doubled the amount of physical cash they hold in their own vaults to more than €90bn — on which they avoid paying negative interest — the ECB said.

But that remains tiny compared with more than €6tn in eurozone bank deposits, and the ECB added that “this has not occurred to an extent that would provide strong signals of a leakage of liquidity away from the banking sector and into cash”.

Estimating that negative interest rates had increased bank lending by about 0.7 percentage points a year, the ECB concluded that the policy had boosted economic growth and lifted inflation higher than it would otherwise have been.