The coronavirus crisis has inflicted terrible economic pain across Europe, but central and eastern European countries may suffer less than their western neighbours, according to forecasts from the European Bank for Reconstruction and Development published on Wednesday.

The former communist countries that joined the EU in two waves in 2004 and 2007 could even benefit from shifting post-pandemic supply chains.

The economies of central Europe and the Baltic states will collectively shrink by 4.3 per cent this year, the development bank predicted, but will bounce back with 4.5 per cent expansion next year. The bank had expected the region to grow by 3.2 per cent this year, so it still amounts to a brutal contraction.

The EBRD numbers are more optimistic than the spring forecasts put out by the European Commission earlier this month. But both sets suggested the economic damage will be less severe in the east than in the south, where Covid-19 has exacted a much heavier human toll and required a longer economic shutdown, including of the vitally important tourist trade.

Riga’s financial district © Gorshkov13/Dreamstime.com

The EU’s southern and eastern member states earlier this year formed an ad hoc alliance to try to extract larger contributions from the bloc’s richer nations to its next seven-year budget. But now harder-hit Spain and Italy will want a bigger share of the pie, raising the question of whether the cohesion alliance can stick together as the fraught negotiations go down to the wire.

Brussels is drawing up plans for a recovery fund potentially worth hundreds of billions of euros. European commissioners will meet on Thursday to discuss the latest proposals. Commission president Ursula von der Leyen said on Wednesday that the new fund would be funnelled to regions “that have been most affected and where resilience needs are greatest”.

Central European governments so far have contained the virus with great success. They saw what was happening in Italy and locked down early and hard. Fewer international travel connections and lower population density became advantages. They were among the first to loosen economic restrictions.

“The fact that they dealt with the virus well augurs well for the easing of the lockdown,” said Beata Javorcik, EBRD chief economist.

Ms Javorcik pointed to other advantages. Lower public debt burdens have given the region fiscal space to support their economies and workers. Poland’s stimulus package amounts to 6.5 per cent of gross domestic product and to 15 per cent including loan guarantees. A smaller share of their workforces are on temporary contracts or are self-employed than, for example, in Italy. Forced adoption of digital technologies during the crisis could help eastern Europe’s tech laggards to catch up.

As the economy recovers, central and eastern Europe could also benefit as European businesses seek to make their supply chains more resilient and less dependent on China. The region already has comparative advantages and high export volumes in sectors where China is otherwise the globally dominant supplier, such as cars, machinery, pharmaceutical and medical supplies. The possibility that the EU might one day levy a carbon tax on products imported from countries shirking their responsibilities to reduce CO2 emissions could accelerate the shift, Ms Javorcik added.

The manufacturing economies of central Europe are coupled to the German industrial locomotive. For the moment, that seems like another advantage. Germany is the least-badly affected of the EU’s big economies and less dependent on services, so it may recover more quickly than France, Italy or Spain once its factories crank up fully again. Unless the German motor sputters, it may become harder and harder for the former communist bloc countries to defend the vast EU financial transfers they have enjoyed for the last two decades.

[email protected]; @hallbenjamin

Your coronavirus reads

Americans are on the move again. A New York Times analysis of cell phone data shows that 25m more people left their homes on an average day last week compared with the previous six weeks. But is it all happening too soon? (NYT)

Marcel Fratzscher, president of the DIW Berlin think-tank, writes that EU institutions need to take the German constitutional court’s decision seriously, or else “catastrophic consequences” could follow. This may not be the court’s last ruling against the ECB, and its arguments resonate deeply in Germany, he says in Project Syndicate.

What will professional sports events be like when they restart without fans in attendance? The Economist weighs the impact of coronavirus on the football, cricket and tennis arenas of the world. (The Economist)

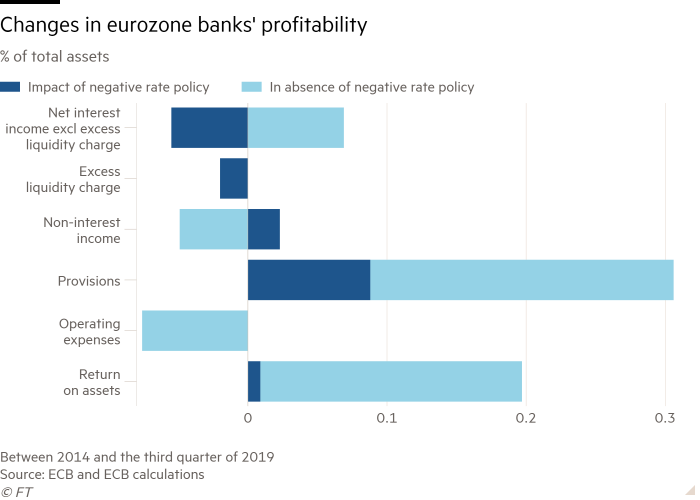

Chart du jour: negative feedback

Negative interest rates are the source of perennial grumbling from European lenders, who say the European Central Bank’s sub-zero deposit rate is a big reason for their weak returns. But the ECB has argued in a research paper that six years of negative interest rates have done as much to boost profitability at eurozone banks as they have to weigh it down. (FT)

Coronavirus news round-up

Greener cash for clunkers

The EU should co-ordinate plans for member states to offer incentives to citizens who purchase electric cars as part of efforts to boost the recovery, according to a new paper laying out a swath of proposals for a greener post-corona rebound, writes Sam Fleming.

The paper, co-written by think-tanks Europe Jacques Delors (Brussels) and the Jacques Delors Institute (Paris) and published on Thursday, says a European green recovery plan could both create jobs and enhance environmental protection, delivering a “double win”.

The EU could propose support ranging from €2,000 to €15,000 for the car purchases, the paper said, while suggesting that the bloc could also spend around €10bn for at least a million electric charging points by 2024.

© REUTERS

The ideas are among proposals in five sectors — buildings, road mobility, clean innovation, waste management and coastal tourism. “In those five sectors alone, the EU and its Member States could safely invest a total of at least €800 billion in the next five years, as part of a green recovery plans,” the paper finds.

The recommendations will be discussed in an event this afternoon featuring EU commissioner Paolo Gentiloni and MEP Pascal Canfin, in conversation with Pascal Lamy, Geneviève Pons and Thomas Pellerin-Carlin.

Pillars of the recovery

Ursula von der Leyen set out her plans for how to finance the recovery to MEPs on Wednesday. In classic Brussels style, it involves “three pillars”, an “instrument” and a “tool”. The proposals, to come later this month, will beef up the EU cohesion fund and provide other support to the hardest hit regions through a mixture of loans and grants.

Other eye-catching parts of the package, all to be financed through borrowing against the EU budget, include a “strategic investment facility” to make sure critical medicines and other vital products are made within the EU, and a new “solvency instrument” to support viable businesses laid low by lockdowns.

Staying out / in for the summer

EU citizens hoping for clear guidance as to whether or not they can book their summer break will have to keep waiting. The commission published guidelines on Wednesday on how to kick-start tourism — from a gradual opening of borders to wearing masks on planes. But Brussels acknowledged that everything hinges on the success of Europe’s fight against the virus: travellers keen for some fresh air will have to use their own judgment when booking a break. (FT)

Pandemic violence

The coronavirus pandemic has mostly failed to damp armed conflicts across the world despite a UN plea to use the crisis to promote a global ceasefire, according to new research and other experts. Warring parties responded to the UN call in only 10 of 43 countries surveyed by the Armed Conflict Location & Event Data Project (Acled) — and in just two of those cases did violence significantly pause. (FT)

Brussels for the chop

Europe’s capital breathes a sigh of relief on the news that hairdressers will open next week as part of the latest stage of the country’s deconfinement strategy. RTBF reports that markets and museums will also be making a comeback. Most importantly, primary and secondary schools will reopen their doors.

Pan-European express

Orban’s law

The European Parliament will discuss Hungary’s controversial emergency law, which in late March gave premier Viktor Orban the right to rule by decree indefinitely, writes Valerie Hopkins. Mr Orban will be represented by just minister Judit Varga, who on Wednesday attempted to portray the hearing as a politically-motivated “lynching” on Twitter.

Brussels has been careful in its criticism of the March 30 “enabling law”, which also included prison sentences of up to five years for people found to be spreading false news about the pandemic. However, commission vice-president Vera Jourova said European institutions would be monitoring its implementation closely.

Orban critics have said the law is ripe for abuse. On Tuesday, a 64-year-old man was detained for a status he wrote on Facebook describing Mr Orban as a “dictator”. He was eventually released with no charge. On Wednesday, an opposition activist was detained for a critical post discussing the number of empty hospital beds in his town of Gyula. His electronics were seized and an investigation is ongoing.

Rough justice

Peter M Huber, the judge who drafted last week’s German constitutional court opinion, has told the Frankfurter Allgemeine Zeitung that an infringement procedure against Germany by the European Commission “would trigger a significant escalation, potentially tipping Germany and other member states into a constitutional conflict that would be very difficult to resolve”. The commission has responded by saying “we don’t comment on comments”.

Coming up

Vera Jourova, commission vice-president for values, will be in conversation with Michael Leigh, senior fellow at Bruegel and Sam Fleming, FT Brussels bureau chief, in the latest Bruegel/FT livestream discussion with EU policymakers. Tune in on Thursday at 12.30 CET.

[email protected]; @Sam1Fleming