A belief that central banks will ride to the rescue of the coronavirus-hit global economy has strengthened, as the financial fallout from measures taken to attempt to control the outbreak has become more apparent.

A litany of factory closures, mass quarantines and travel bans that is increasing by the day will almost certainly scupper the modest uptick in global growth that was widely predicted for this year, with few countries likely to escape their share of the pain.

Expectations are growing of a so-called global recession, which many are describing as growth of less than 2.5 per cent.

On Monday, the OECD cut its 2020 global growth forecast from the 2.9 per cent it foresaw in November to 2.4 per cent, adding that a “longer lasting and more intensive coronavirus outbreak” could force growth as low as 1.5 per cent.

As a result, markets are now pricing in almost one and a half rate cuts by the time of the US Federal Reserve’s March meeting. At the start of the year, the consensus was that even a single cut during the course of 2020 was not a done deal.

The European Central Bank is now priced for a tenth of a percentage point cut this year, a reversal of January’s position, when investors had begun tentatively pricing in rate rises in 2021. Markets are also pricing slightly more than one Bank of England cut this year, while the Bank of Japan has said it is “well prepared” to ease monetary policy if needed.

The impact may be very different in large parts of the emerging world, however, with some central banks potentially forced to call a premature halt to their monetary easing cycles as a result of recent coronavirus-driven market swings.

Almost all freely traded emerging market currencies have weakened in recent weeks as a risk-off trading environment has led investors to hunker down in “haven” currencies such as the US dollar and Swiss franc. Commodity-exporting countries have been doubly hit, as the price of oil and metals has tumbled amid weakening global demand.

The South African rand has led the way, sliding 11.1 per cent against the dollar so far this year, despite the country reporting no cases of the novel coronavirus thus far.

Latin America has also had minimal confirmed cases of the virus, yet the Brazilian real has fallen 10.8 per cent since the start of the year, with the Chilean peso down 8.3 per cent and the Colombian peso, 7.5 per cent.

The Russian rouble has lost 7.6 per cent, with the Turkish lira, South Korean won and Mexican peso among others to have sold off.

The currency falls will lead to higher inflation by raising the price of imported goods and services.

Edward Glossop, emerging markets economist at Capital Economics, predicted that the sell-offs would push up inflation over the next year by at least 0.6-0.7 percentage points in Russia and South Africa, strengthening his view that monetary easing cycles in both countries are now “close to an end”.

This would come even as economic growth is likely to come under pressure, given the duo’s heavy reliance on commodities, with the OECD cutting its Russian growth forecast by 0.4 percentage points to 1.2 per cent and halving its expectations for South African to just 0.6 per cent, well below population growth.

Mr Glossop also saw a similar currency-driven pick up in inflation in Turkey, where he believed the central bank would reverse course and start raising interest rates in the second half of the year.

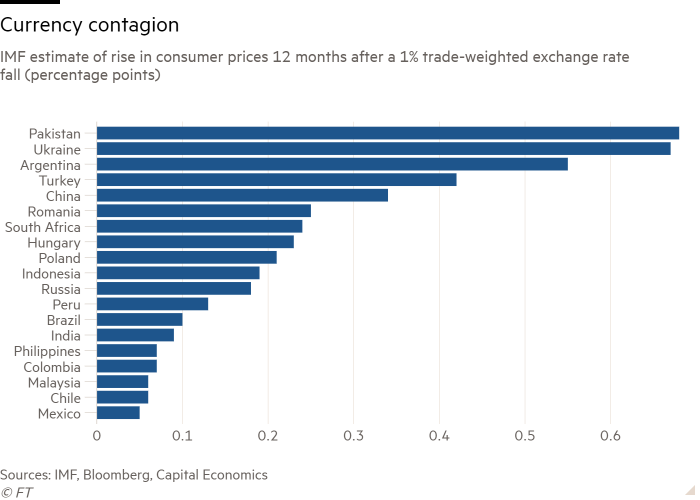

Russia, South Africa and Turkey are the most vulnerable among large EM economies because of their high pass-through rates from currency to inflation, a factor driven by their degree of trade openness, central bank credibility, inflation expectations and the size of their output gap, Mr Glossop said.

Pakistan, Ukraine and Argentina have still higher rates of pass-through from exchange rate weakness to inflation, according to calculations by the IMF.

Countries such as Poland, Brazil and South Korea are also likely to see inflation increases of at least 0.3 percentage points thanks to the falls in their currencies, with more modest rises in Mexico, Chile, Colombia, Malaysia and the Czech Republic, Mr Glossop added.

The reaction of central banks to higher inflation is likely to vary country-by-country, however.

“Some [such as Mexico] will be spooked by any signs that currency weakness is driving inflation higher. Others, mostly in Asia, will prioritise supporting growth,” Mr Glossop argued.

Other effects may also come into play. The fall in the oil price, which has tumbled 24 per cent this year, will help reduce inflation in many countries, as should weaker demand in general.

Balanced against this may be a range of supply disruptions, which could push prices higher in certain product categories.

Global laptop shipments, for example, were likely to have halved in February, according to Trendforce, a Taiwan-based technology industry research firm.

Global garlic and ginger prices have also shot higher, due to logistical difficulties in getting supplies out of China, a major exporter. Japan has also reported a sharp fall in imports of vegetables from China, its biggest foreign supplier.