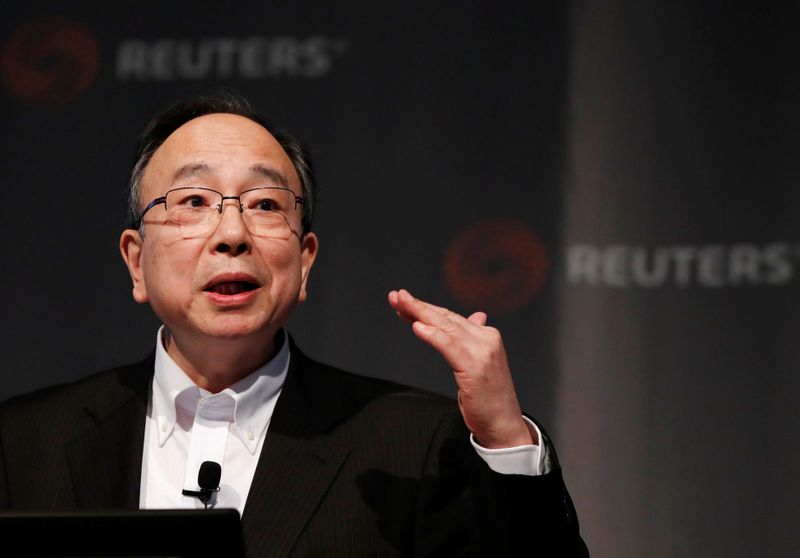

© Reuters. Bank of Japan Deputy Governor Masayoshi Amamiya speaks during a Reuters Newsmaker event in Tokyo

© Reuters. Bank of Japan Deputy Governor Masayoshi Amamiya speaks during a Reuters Newsmaker event in TokyoBy Leika Kihara

TOKYO (Reuters) – The Bank of Japan must be ready to issue digital currencies if rapid technical advances in settlement systems boost public demand, its deputy governor said, leaving open the chance of issuing central bank digital currencies (CBDC) in the future.

Masayoshi Amamiya said the BOJ had no immediate plans to issue CBDCs as various factors must be scrutinized, such as the impact on monetary policy and measures to ensure strict security standards.

But he said it was “very important” for Japan’s central bank to continue examining the possibility of issuing CBDCs, he said, offering the strongest comment to date from a BOJ executive on the potential of digital currencies.

“The speed of technical innovation is very fast. Depending on how things unfold in the world of settlement systems, public demand for CBDCs could soar in Japan,” Amamiya said in a seminar in Tokyo on Thursday.

“We must be prepared to respond if that happens,” he said.

Amamiya said the way monetary policy affects interest rates, asset prices and bank lending likely will not change much even if central banks begin issuing their own digital currencies.

“But the transmission mechanism…could become more complicated and difficult (to break down) if settlement systems change,” he added.

Some U.S. academics say digital currencies would allow central banks to more easily impose negative interest rates on deposits, something that is “worth looking into,” Amamiya said.

Facebook’s (O:) push to launch its Libra cryptocurrency has prodded central banks to quicken the pace at which they look at issuing digital currencies.

The central banks of Britain, the euro zone, Japan, Canada, Sweden and Switzerland last week announced a plan to share experiences to look at the case for issuing digital currencies, amid a growing debate over the future of money.

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.

Source: Economy - investing.com