Your level-headed briefing on how the coronavirus epidemic is affecting the markets, global business, our workplaces and daily lives, with expert input from our reporters and specialists across the globe.

For updates visit our live blog. Please send your reactions and suggestions to [email protected]. We would like to hear from you.

The FT is offering a free 30-day trial to Coronavirus Business Update, which includes access to FT.com. Please spread the word by forwarding this newsletter to friends and colleagues who you think would find it valuable. And if this has been forwarded to you, hello. Please sign up here

Latest news

European regulators are ending bans on short selling introduced in March to mitigate market gyrations caused by the impact of the pandemic

Uber, the ride-hailing company, said it would cut a further 3,000 jobs, close or consolidate 45 global offices, and reduce investments in several “non-core” projects

The member clubs of England’s football Premier League voted to allow players to begin training in small groups while maintaining social distancing. Scotland’s top football league has called an end to its season

Accentuating the positive

The week started as every week does with data highlighting the extent of the damage caused by the coronavirus pandemic. But this time — whether fuelled by central banks, the easing of lockdowns or hopes for a vaccine — it’s possible to discern a distinct whiff of optimism.

The Bundesbank this morning felt confident enough to say “a recovery is under way” in Germany, the EU’s biggest economy, even after a sharp contraction in April. And in the US, Federal Reserve chair Jay Powell — even as he warned that a full recovery might take until the end of next year — reassured markets that the central bank “wasn’t out of ammunition by a long shot”.

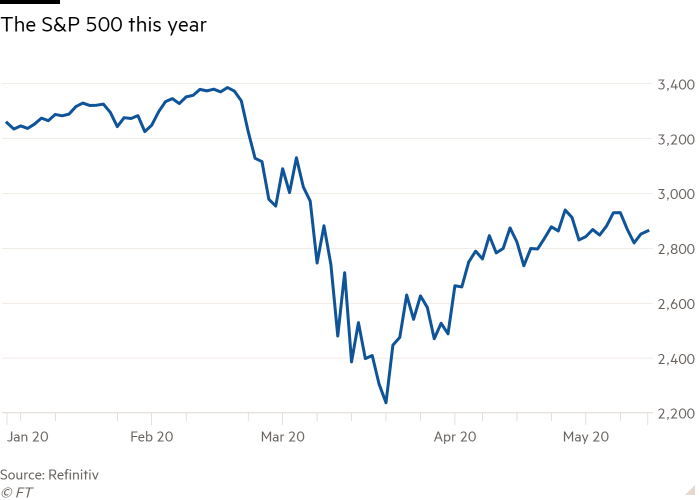

Global investors have also taken hope from the absence — thus far at least — of a serious second wave of infections. Wall Street received a further boost today from positive results in the first US Covid-19 vaccine trial, carried out by Moderna, the Boston-based biotech. The S&P 500 is already up more than 25 per cent since hitting lows in late March.

Challenges still lie ahead, especially in Europe.

Chief foreign affairs commentator Gideon Rachman highlights the dangers of conflict between Germany and the European Central Bank on the bank’s bond-buying programme, while our Big Read today focuses on the task facing European commission president Ursula von der Leyen as she attempts to bridge bitter divides across the bloc on the size and shape of an EU recovery fund.

Her attempt at overcoming the impasse was, however, given a boost late on Monday by proposals from Germany’s chancellor Angela Merkel and French president Emmanuel Macron for a €500bn package for Europe’s hardest-hit areas. The plan may encounter resistance from some member states, but, in the spirit of the day, was welcomed by the commission chief as “acknowledging the scope and the size of the economic challenge that Europe faces”.

Markets

The US regulator is set to relax curbs on speculators in commodities markets, despite the recent volatility in crude oil. New rules from the Commodity Futures Trading Commission would double position limits for investors in markets such as oil, natural gas, gold, corn and soyabeans, and be less restrictive on energy and metal contracts.

Dividends worth up to $500bn could be wiped out as companies around the world try to shore up balance sheets from the economic damage of the pandemic. Even the best-case scenario for global dividends, according to one fund manager, is cuts of $213bn, leaving a total payout of $1.21tn, a 15 per cent decline.

The pandemic is hastening the decline of the US coal industry as the fuel gets crowded out of a shrinking electricity market and the move to cleaner fuels speeds up.

Business

The collapse in demand for new clothes from housebound consumers has wiped out retailers’ revenues, with McKinsey estimating that up to a third of global fashion players, such as brands and department stores, will not survive the crisis. The impact is being felt all along the $2.5tn industry’s complex supply chains, explains our Big Read.

“Bank loan loss provisions are likely to be only the tip of a looming iceberg,” says Patrick Jenkins, FT deputy editor. With the effects of the pandemic set to be much harsher than the 2008 financial crisis, banks really need to consider raising new capital, he says.

Now the immediate shock of the pandemic is over, investors and company bosses are exploring how business can “build back better”, creating a more sustainable world and corporate sector alike, says Gillian Tett, US editor at large. See the list of “saints and sinners” and more in our special report: Responsible Business in a Crisis.

Global economy

China’s president Xi Jinping called for international supply chains to be kept open as the world struggles to rebound from the pandemic. Mr Xi, speaking at the annual meeting of the World Health Organization, promised $2bn over two years to help the worldwide response and backed a “comprehensive review” into how the world had dealt with the emergency once it was “under control”.

Governments around the world must make sure that economies are not overwhelmed by a wave of corporate failures, says the FT editorial board. Even if companies need eventually to be restructured, the key for the moment must be to flatten the curve of bankruptcies and stop the legal infrastructure becoming swamped, it says.

Although the pandemic has led to a loosening of some privacy rules around digital health in countries such as the UK, the EU has demanded that US tech giants share detailed information on how they are tackling disinformation. Read more in our special report: Future of AI and Digital Healthcare.

Could Covid-19 put globalisation into reverse? Senior trade writer Alan Beattie’s video examines the rise and fall of global trade from the Romans to coronavirus. In just 10 minutes.

Readers respond

Michelle Gahagan writes:

I’d love to hear discussion related to the rather obvious distinction that needs to be made between holidaymakers and those who really need to get back to their businesses. The current border restrictions make no attempt whatsoever to do so. I happen to own the biggest bike rental fleet in France. We’ve got $2m worth of high-end rental bikes sitting in a warehouse in Provence with no tourists likely for months — managing 20 staff through Zoom from here in Vancouver is proving to be a serious challenge. Discussion around the fact that business travel can and should start before we worry about how to descend on Disneyland Europe or the Trevi Fountain with our selfie sticks is certainly warranted.

Get in touch

How is your workplace dealing with the pandemic? And what do you think business and markets — and our daily lives — will look like after lockdown? Please tell us by emailing [email protected]. We may publish your contribution in an upcoming newsletter. Thanks

The essentials

Explore data about the pandemic to better understand the disease’s spread and trajectory in the live-updating and customisable version of the FT’s Covid-19 trajectory charts.

A quarantine and testing regime for travellers in Taiwan could provide a model for other countries. The aim of the trial — with Stanford University in the US — is to find the shortest safe quarantine period so that people who have to make brief trips for business could be allowed to leave quarantine after a few days rather than two weeks.

A lot of hope has been pinned on contact tracing apps to help economies re-emerge from lockdown by containing infection rates, but they are struggling to make an impact in early adopters such as India, Norway and Singapore. The UK said today its app would be delayed.

Social distancing has hit sectors dominated by women, such as hospitality, very hard while school closures have hugely increased childcare needs, badly affecting working mothers. Has coronavirus advanced or set back women at work? Columnist Emma Jacobs and US banking editor Laura Noonan took readers’ questions today.

Final thought

From digital consultations with doctors to cleaner air from motoring restrictions on city streets, columnist Pilita Clark picks out the consolations from a miserable period in human history. “As an enthusiastic but nervous cyclist, I have watched other cities around Europe introduce similar measures with a familiar sense of dread that nothing like this would ever happen in London,” she writes. “Yet suddenly it has.”