By Jesse Cohen

Investing.com – U.S. stocks edged lower on Thursday, but the S&P 500 was still on track for its best monthly performance since 1974, as global central banks provided more stimulus to combat the impact of the coronavirus pandemic.

The moves on Wall Street followed another strong session for stocks on Wednesday, which saw the S&P 500’s gain for the month of April reach more than 13%. The Dow is up 12.4% for April and is headed for its biggest monthly climb since 1987.

Both are well within 20% of their record levels reached in February, with the tech-heavy Nasdaq 100 now within 10% of its all-time high.

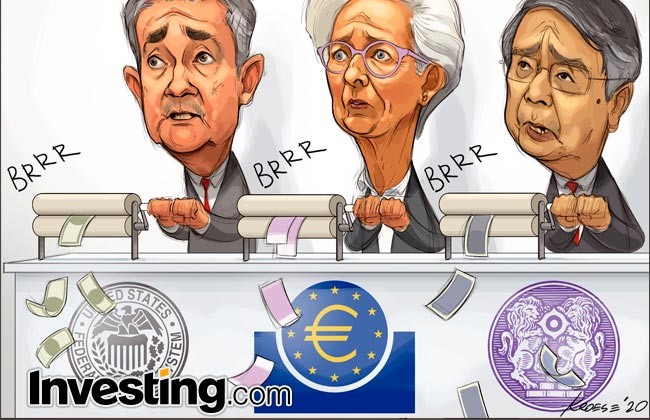

The Federal Reserve wrapped up its two-day monetary policy meeting on Wednesday, leaving key interest rates near zero and vowing to use a “full range” of its tools to aid the economy in the face of a pandemic that poses “considerable” medium term risks.

“We are doing all we can” to help American households and businesses weather the public health emergency, Fed Chair Jerome Powell told journalists after the end of the policy meeting, which was also held via videoconference.

The U.S. central bank has already slashed interest rates to zero, and it reiterated they will stay there until the economy is clearly back on track. It has also rolled out around $2 trillion in lending commitments, and Powell said it was ready to do more as needed.

“We will continue to use our tools to ensure that the recovery, when it comes, will be as robust as possible,” Powell said, specifically noting the Fed’s willingness to set up even more, and riskier, lending programs than it already has if the U.S. Treasury agrees.

Meanwhile, the European Central Bank said on Thursday it would pay even more for banks to borrow from it but kept much of its remaining policy powder dry as it prepared for a long fight against the coronavirus’s fallout.

After unveiling a raft of stimulus measures over the last six weeks, including plans to buy 1.1 trillion euros worth of assets this year, the ECB said it would pay banks 0.50% for tapping its multi-year auction and 1% if the pass on that cash to the economy.

Earlier in the week, the Bank of Japan expanded monetary stimulus and pledged to buy an unlimited amount of bonds to keep borrowing costs low, as the government tries to spend its way out of the growing economic pain from the coronavirus pandemic.

BOJ Governor Haruhiko Kuroda said on Monday the central bank was ready to act further to fight the impact of the novel coronavirus, which he said could do more harm to the global economy than the 2008 collapse of Lehman Brothers.

To see more of Investing.com’s weekly comics, visit: http://www.investing.com/analysis/comics

— Reuters contributed to this report