Uber could become a profitable company sooner than was once projected and investors should expect the stock to have more upside, CNBC’s Jim Cramer said Monday.

“After that phenomenal quarter … last Thursday, Uber’s clearly gotten its act together,” the “Mad Money” host said while breaking down the company’s fundamentals.

For the fourth quarter, Uber on Thursday reported losses that were smaller than the analyst community estimated — 64 cents versus 68 cents — and revenue grew 37% to $4.07 billion, which topped estimates of $4.06 billion. Uber moved up its profitability timeline for earnings before interest, taxes, depreciation and amortization, or EBITDA, from 2021 to the fourth quarter of this year.

“I’m betting this stock can sail past $45 — it is no longer just a taxi service — and I think it can keep climbing as long as management can hit the profitability targets they laid out last week. And I believe in their ability to make the numbers.”

Cramer turned favorable on Uber in November in the wake of the ride-hailing company’s lockup period expiration. The stock bottomed at about $26 in November and has accelerated 54% to $39.99 as of Monday’s close. Shares are just over $2 shy of its debut price last May and about $6 away from its closing high in June.

Uber executives have their mind set on turning profits, and Cramer lauded the moves the company has been making to reach that goal. Last month, Uber sold its Uber Eats India operations to Zomato and gained equity in the business. The deal mirrors similar moves the company made in recent years to exit the food-delivery business in China and Southeast Asia, which gave Uber a 20% stake in Didi Chuxing and a 27.5% stake in Grab, the host noted.

Uber Eats has been a “black hole” for the company, Cramer said, as it competes with the likes of GrubHub, DoorDash and Postmates in a low-margin industry.

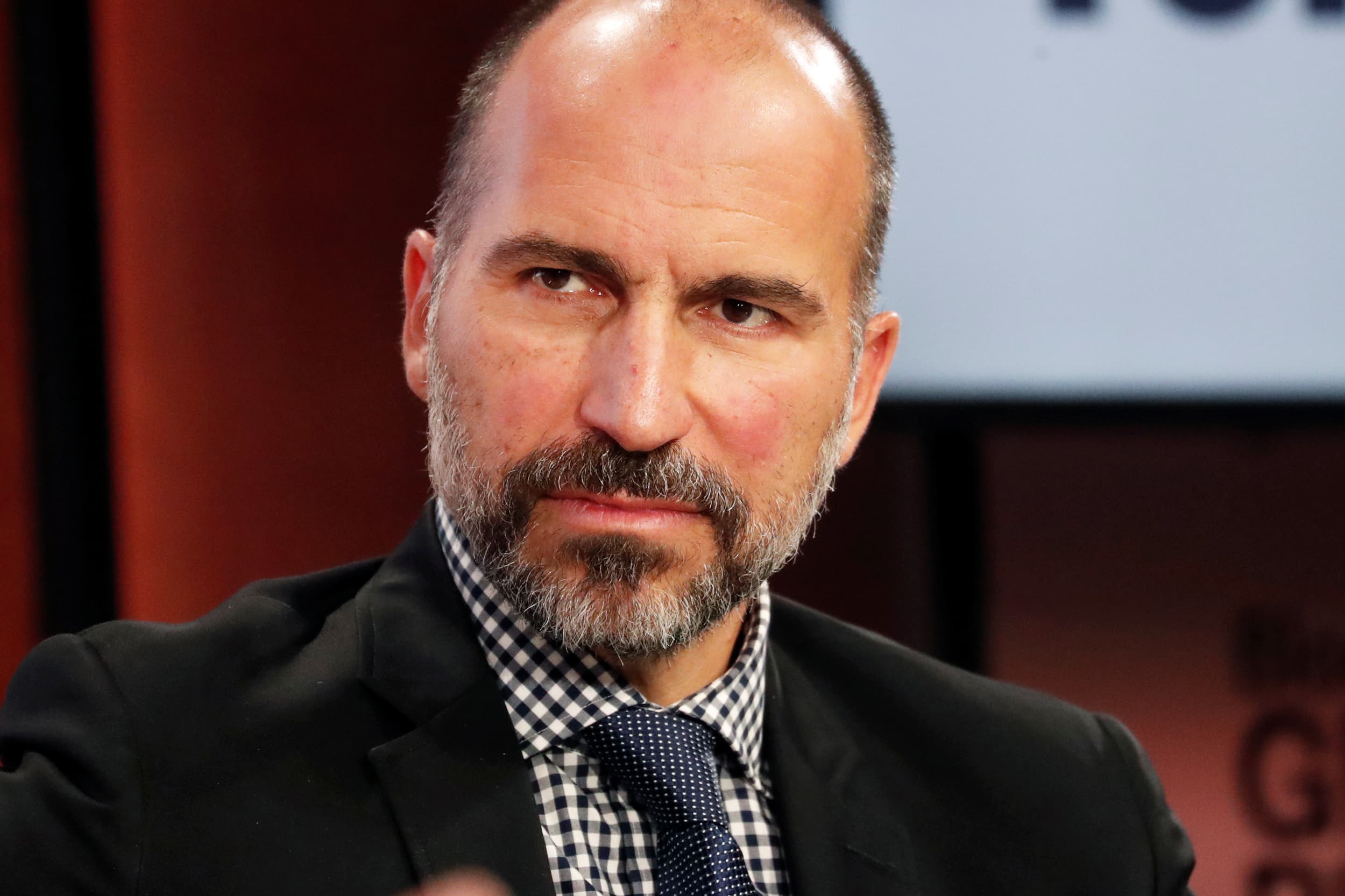

“CEO Dara Khosrowshahi has gotten aggressive about exiting markets where the company’s losing too much money. … Basically, Uber keeps dropping money-losing businesses and exchanging them for ownership stakes in market leaders,” he said. “In the long run, I think these overseas bets could be huge winners, like when Yahoo took a small stake in Alibaba. … More importantly, though, in the short term they’re paring back expensive money-losers to focus on profitability.”

Cramer is pleased that Uber’s ride-hailing segment is profitable. The app brought in $742 million of EBITDA earnings. To hammer home the goal of becoming a profitable company, Khosrowshahi said he plans to invest 50 cents of every dollar of revenue growth toward achieving it.

“Of course, Uber’s not perfect. They’re in a constant war against local regulators, who tend to favor the interests of local cab companies,” Cramer said, adding that he still holds reservations about Uber’s food delivery and trucking businesses. “But at $40, [Uber] is worth it. Remember, this thing came public last spring at $45, and it was a much worse company back then.”

Source: Business - cnbc.com